Senior Car Insurance: Smart Choices for Older Drivers

Finding the right car insurance as you age requires more than shopping for the cheapest rate. Seniors often balance changing driving habits, medical considerations, and vehicle needs while looking for coverage that protects assets and fits a fixed budget. This article explains what to consider, how coverage differs, and practical steps seniors can take to keep driving safely and affordably.

Car ownership: what seniors need to know

Owning a car later in life often means different priorities than in earlier years: comfort, ease of access, and safety upgrades become more important than speed or extra features. Simple vehicle modifications — higher seats, grab handles, pedal extensions, or swivel cushions — can make entering and exiting easier and reduce physical strain. Regular maintenance is also essential; older vehicles with worn brakes or tires can increase risk. When evaluating a car for daily use, consider models with good visibility, advanced driver-assist features, and lower repair costs to keep long-term ownership manageable.

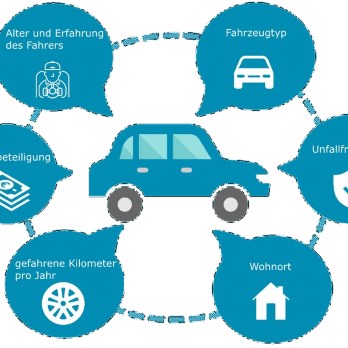

Insurance basics for older drivers

Insurance for seniors follows the same core structure as for any driver: liability, collision, comprehensive, and optional protections like uninsured motorist coverage or medical payments. What changes most are policy details — deductible choices, coverage limits, and exclusions related to named drivers. Many insurers ask drivers to report significant life changes (address, driving frequency, or household members) because those affect risk. Comparing quotes, asking about bundling with other policies, and reviewing coverage limits annually can prevent gaps in protection and ensure the policy aligns with current needs.

How seniors’ driving changes risk

Aging can affect vision, reaction time, and the ability to handle complex driving situations; medications and medical conditions may also influence driving performance. These factors can change risk profiles for insurers and may influence premium pricing or coverage decisions. Regular driving assessments, vision checks, and consultations with healthcare and driving professionals can help identify when adjustments are needed. This article is for informational purposes only and should not be considered medical advice. Please consult a qualified healthcare professional for personalized guidance and treatment.

Vehicle coverage options explained

Beyond required liability coverage, seniors should evaluate optional coverages that match their vehicle use and assets. Collision covers damage to your vehicle after an accident, while comprehensive protects against non-collision events like theft or weather damage. Gap insurance can be useful if you lease or finance a newer vehicle. Consider roadside assistance and rental reimbursement if you rely on your vehicle for errands or appointments. Policy deductibles affect premium costs — higher deductibles lower premiums but increase out-of-pocket expense after a claim — so choose amounts that fit your emergency budget.

Practical tips for driving and discounts

Many insurers offer discounts that seniors can pursue: defensive driving course discounts, low-mileage reductions for those who drive less, multi-policy or multi-vehicle discounts, and savings for vehicles equipped with safety features. Some companies provide age-based discounts or personalized underwriting for mature drivers with clean records. Keep a record of safe driving, complete accredited refresher courses if available, and ask about local services that offer driving evaluations. When seeking discounts, verify that the savings apply in your area and confirm any documentation required to qualify.

Conclusion

Selecting senior car insurance is about matching coverage to changing needs: assess your vehicle, understand policy components, monitor health and driving ability, and look for discounts or local services that support safe mobility. Regular policy reviews and modest vehicle or habit adjustments can help maintain independence behind the wheel while keeping financial and safety concerns in balance.