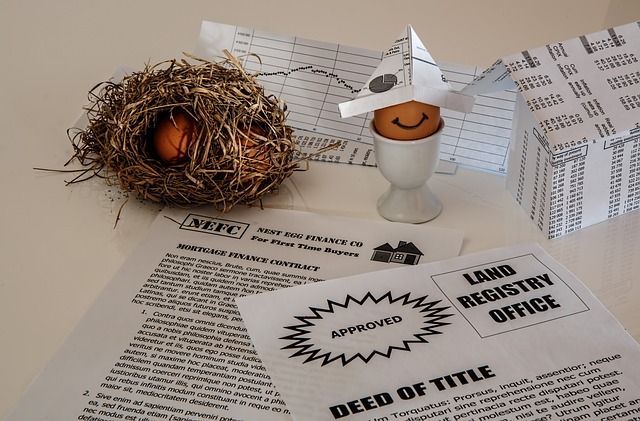

Release Home Equity: Unlock Your Property's Value Today

Equity release lets homeowners—often retirees—convert part of their property's value into tax-free cash without moving out. Ideal for boosting retirement income, funding home work or helping family, it offers lump sums or regular payments. Learn how it works, who qualifies, risks like reduced inheritance and benefit impacts, and the costs to consider before deciding.

What is equity release and how can it help?

Equity release is a way for older homeowners to access the money tied up in their property while remaining in their home. Rather than selling or downsizing, you can receive either a lump sum or ongoing payments based on your home’s value. Many retirees use these funds to supplement retirement income, carry out home improvements, clear outstanding mortgages, or financially assist relatives.

Key advantages

- Access tax-free cash without moving: You keep living in your home while converting part of its value into usable funds.

- Flexibility of use: Funds can pay off existing debt, cover renovations, support family, or boost everyday income.

- Ownership retained: Most plans let you remain the registered owner and continue living in the property.

Potential downsides and risks

Equity release can provide welcome liquidity, but it has important trade-offs to weigh:

- Lower inheritance: Releasing equity reduces the estate you can pass on to heirs.

- Interest can grow quickly: Lifetime mortgage interest compounds, which may substantially increase the debt over time and, if house prices fall, raise the risk of negative equity.

- Effect on benefits: Receiving equity may change your eligibility for means-tested state benefits.

- Less flexibility to move: Downsizing or moving house can become more complicated and sometimes costly.

Who normally qualifies?

Eligibility criteria vary between providers, but common requirements include:

- Minimum age: Most schemes are available to homeowners aged 55 and over, though some lenders set a higher minimum.

- Main residence: The property must usually be your primary home and meet the lender’s valuation standards.

- Mortgage status: Any existing mortgage typically needs to be repaid either from the equity release proceeds or by other means as part of the arrangement.

How much could you borrow?

The amount available depends on factors such as your age, the value of your property and, in some cases, your health. Generally, older applicants and those with higher-value homes can access a larger proportion of equity. Typical maximum loan-to-value (LTV) ratios from providers tend to sit around 50–60%, though exact limits differ by lender. Bear in mind that taking the full amount offered isn’t always advisable because it will further reduce what you can leave to beneficiaries.

Costs to expect

Equity release plans come with a range of fees and charges. Typical costs include:

- Interest rates: Often fixed for the life of the plan but frequently higher than standard mortgages.

- Arrangement fees: One-off charges to set up the product.

- Valuation fees: The cost of a professional property valuation.

- Legal fees: Payment for the solicitor work required to complete the deal.

- Early repayment charges: Fees that may apply if you repay the loan sooner than agreed.

Provider examples (typical rates and maximum LTVs)

| Provider: Aviva | Product: Lifetime Mortgage | Interest Rate (APR): 3.75% - 6.78% | Maximum LTV: Up to 55% |

| Provider: Legal & General | Product: Lifetime Mortgage | Interest Rate (APR): 3.77% - 7.07% | Maximum LTV: Up to 58% |

| Provider: Canada Life | Product: Lifetime Mortgage | Interest Rate (APR): 3.59% - 6.99% | Maximum LTV: Up to 54% |

| Provider: More2Life | Product: Lifetime Mortgage | Interest Rate (APR): 3.40% - 7.19% | Maximum LTV: Up to 56% |

Note: These prices, rates and estimates are based on the latest available information and may change. Always carry out up-to-date, independent research when comparing options.

Final considerations

Equity release can be a useful tool for homeowners seeking extra funds later in life, but it’s a significant financial decision with long-term consequences. Talk to an independent financial adviser, discuss plans with family members and weigh alternatives before proceeding. Understanding the impact on inheritance, benefits and future flexibility will help you decide whether equity release is right for your circumstances.