Understanding Student Loans and Scholarships: A Comprehensive Guide

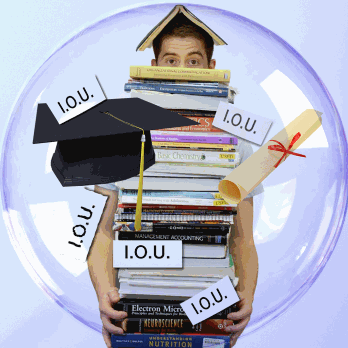

Navigating the world of higher education financing can be a daunting task for many students and their families. With the rising costs of college tuition, it's crucial to understand the various options available to fund your education. This article will delve into the two primary forms of financial aid: student loans and scholarships, providing you with essential information to make informed decisions about your educational future.

When you take out a student loan, you agree to repay the borrowed amount plus interest over a specified period. Most federal student loans don’t require repayment while you’re in school, and many offer a grace period after graduation before repayment begins. It’s important to carefully consider the terms of any loan and understand your repayment obligations before borrowing.

How can scholarships benefit students pursuing higher education?

Scholarships are a form of financial aid that doesn’t need to be repaid, making them an attractive option for students seeking to fund their education. These awards can be based on various factors, including academic merit, athletic ability, artistic talent, community service, or specific fields of study. Scholarships can come from a variety of sources, such as colleges and universities, private organizations, foundations, and government entities.

The benefits of scholarships extend beyond just financial assistance. They can also provide recognition for your achievements, enhance your resume, and open doors to networking opportunities. Additionally, receiving a scholarship can reduce your reliance on student loans, potentially decreasing your overall debt burden upon graduation.

What are the key differences between loans and scholarships?

The primary distinction between student loans and scholarships lies in the repayment obligation. While loans must be repaid with interest, scholarships are essentially free money for education. This fundamental difference impacts how students should approach and prioritize these funding options.

Loans provide a more predictable source of funding, as you can borrow up to the cost of attendance minus other financial aid received. However, they come with the long-term responsibility of repayment. Scholarships, while highly desirable, are often more competitive and may not cover all educational expenses. They also frequently come with specific requirements, such as maintaining a certain GPA or studying in a particular field.

Another key difference is the application process. Federal student loans require filling out the Free Application for Federal Student Aid (FAFSA), while private loans typically involve a credit check and may require a cosigner. Scholarship applications can vary widely, often requiring essays, letters of recommendation, or demonstrations of specific skills or achievements.

How can students find and apply for scholarships effectively?

To maximize your chances of securing scholarships, it’s essential to start your search early and cast a wide net. Begin by checking with your high school guidance counselor and the financial aid offices of universities you’re interested in attending. Many schools offer institutional scholarships to incoming students based on academic performance or other criteria.

Utilize online scholarship search engines and databases, which can help match you with opportunities based on your profile and interests. Don’t overlook local scholarships offered by community organizations, businesses, or religious institutions, as these often have less competition.

When applying for scholarships, pay close attention to eligibility requirements and deadlines. Tailor your applications to each scholarship, highlighting how you meet the specific criteria. Craft compelling essays that showcase your unique experiences and aspirations. Remember to proofread all materials carefully and submit your applications well before the deadline.

What factors should be considered when deciding between loans and scholarships?

Deciding between loans and scholarships requires careful consideration of your individual circumstances. While scholarships are generally preferable due to their non-repayment nature, they may not be sufficient to cover all your educational expenses. Consider the following factors:

-

Financial need: Assess your family’s ability to contribute to your education and determine how much additional funding you require.

-

Academic performance: Strong grades and test scores can increase your eligibility for merit-based scholarships.

-

Career goals: Some scholarships are tied to specific fields of study or career paths, which may align with your aspirations.

-

Loan terms: If considering loans, compare interest rates, repayment options, and borrower protections between federal and private loans.

-

Long-term financial impact: Consider how taking on student loan debt may affect your future financial goals and lifestyle.

How can students effectively manage their education financing?

Effective management of education financing involves a combination of strategies. Start by exhausting all available scholarship and grant opportunities before turning to loans. If loans are necessary, prioritize federal loans over private ones due to their more favorable terms and repayment options.

Create a detailed budget that accounts for all your educational expenses and potential sources of income, including part-time work or work-study programs. Consider ways to reduce costs, such as attending a community college for the first two years before transferring to a four-year institution.

If you do take out loans, borrow only what you need and understand the terms of repayment. Consider making interest payments while in school to reduce the overall cost of the loan. Stay informed about your loan status and explore repayment options that best suit your financial situation after graduation.

In conclusion, navigating the landscape of student loans and scholarships requires diligence, research, and careful planning. By understanding the differences between these funding options and strategically applying for scholarships while judiciously using loans when necessary, students can make informed decisions to finance their education effectively. Remember that the goal is not just to fund your education but to do so in a way that sets you up for long-term financial success.