How changes in income sources affect your annual filing

Changes in where your income comes from—salaried employment, freelance work, investments, or rental receipts—can alter what you report, which forms you need, and how much you owe or receive as a refund. Understanding how different income streams interact with withholding, credits, deductions, and documentation helps reduce surprises at filing time and supports compliance with deadlines and audit readiness.

How income changes affect filing and forms

When your mix of income shifts, the core filing requirements can change too. Wage income typically arrives on employer-provided forms, while self-employment, gig work, or rental income may require different schedules or supplemental forms to report profit and loss. Accurate bookkeeping of receipts and expenses for each income type determines which lines on tax forms should be completed. If you receive new types of income mid-year, review the applicable forms and consider whether estimated tax payments or additional documentation will be needed at filing to avoid underpayment penalties.

Withholding, credits and refunds

Different income sources affect withholding and eligibility for credits, which in turn influence refunds or balances due. Employer wages usually have withholding automatically withheld, but freelance or investment income often does not, increasing the chance you will owe at filing. Credits—such as earned income-related credits or education credits—depend on income levels and source timing. Tracking withholding and periodic estimated payments helps prevent large unexpected liabilities and supports more predictable refunds when credits apply.

Deductions, liabilities and bookkeeping

Changes in income often change deductible opportunities and liabilities. Self-employment or rental activities can permit business-related deductions for supplies, home office expenses, depreciation, and other costs; these reduce taxable income but require consistent bookkeeping to substantiate. Conversely, some deductions phase out at higher income levels, which may increase your net tax liability when certain income sources push you into higher brackets. Maintain categorized records so deductions are claimed accurately and liabilities are calculated with clear support.

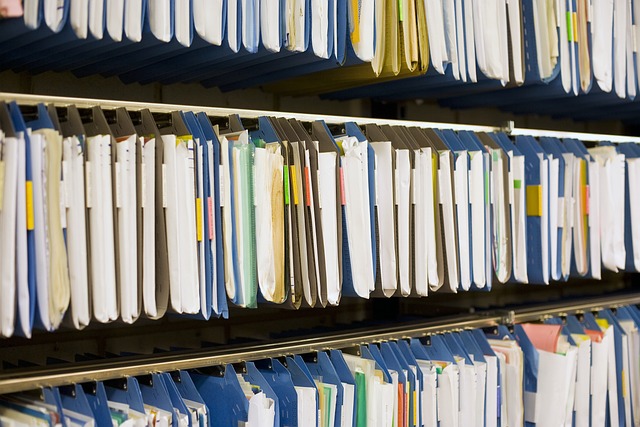

Recordkeeping and documentation requirements

Accurate documentation is essential when income sources diversify. Save invoices, bank statements, 1099s or equivalent income statements, receipts for deductible expenses, and contracts that prove business purpose. Good recordkeeping simplifies efiling, supports claims for credits or deductions, and reduces the burden if an auditor requests evidence. Establish a consistent filing system—digital or physical—with clear labels and dates so documentation can be located quickly at tax-preparation time or during any compliance review.

Deadlines, efiling and compliance

Different income types can change filing deadlines and the need to efile or make estimated payments. Self-employed taxpayers and those with significant non-withheld income commonly must make quarterly estimated payments to stay compliant. Efiling often speeds processing of returns and refunds, but ensure all forms and schedules for new income types are included before submission. Missing deadlines or underpaying estimated taxes can trigger penalties, so align bookkeeping with calendar deadlines and verify efiling instructions for the specific forms related to your income mix.

Audit risk and preparing for audits

Adding new income sources can increase audit attention if reporting is incomplete or inconsistent. Accurate, contemporaneous documentation and organized bookkeeping reduce audit risk and improve the ability to respond to inquiries. Keep copies of forms, contracts, and substantiation for deductions for the recommended retention period in your jurisdiction. If you receive an audit notice, clear documentation of income, withholding, credits, and deductible expenses typically resolves questions more efficiently and supports compliance determinations.

Changes in where your income comes from affect more than the numbers on a return; they influence which forms you file, how you document transactions, and how you plan for withholding, estimated payments, and potential liabilities. Consistent bookkeeping, timely attention to deadlines and efiling rules, and careful documentation of deductions and credits help maintain compliance and reduce surprises at filing or during audits.