How to organize income and expense records for accurate filings

Organized records reduce errors and speed up filing. This article explains practical steps to collect, categorize, and retain income and expense documentation so filings reflect actual finances. It covers payroll and self-employment income, deductible expenses, withholding and refunds, deadlines, efiling, compliance, and preparation for audits.

Keeping clear, consistent records of income and expenses is the foundation of accurate filings. A reliable system minimizes errors, supports claimed deductions and credits, and helps you meet deadlines and compliance requirements. Whether you receive payroll, freelance payments, rental income, or investment returns, collecting source documents and reconciling them regularly prevents surprises at tax time and prepares you for efiling or an audit.

How to document income and payroll

Record every income source: W-2s, 1099s, bank deposits, rental receipts, and any foreign income related to residency. For payroll, keep pay stubs, year-end statements, and employer correspondence to verify withholding and reported wages. Reconcile employer-provided statements with your bank records each month or quarter to catch missed payments or errors early, and tag income entries by type so you can segregate taxable and non-taxable amounts quickly.

Recording expenses and deductible items

Organize expenses into clear categories such as travel, supplies, home office, utilities, and insurance. Save receipts, invoices, and proof of payment; use digital scans with searchable filenames or a bookkeeping app. For mixed personal/business costs, maintain a mileage log or split invoices with notes explaining the business portion. Accurate expense tracking supports deductions and reduces the chance of disallowed items during reviews.

Tracking deductions, credits, and estimates

Document eligibility for tax credits and deductions with supporting paperwork: charitable receipts, childcare invoices, education statements, or energy credits. Keep a record of estimate calculations and payments if you make quarterly estimated tax payments—this includes dates, amounts, and payment confirmation numbers. Regularly review potential credits and deductions to ensure you retain the proper documentation to substantiate each claim.

Managing withholding, refunds, and efiling

Monitor withholding amounts on pay stubs and adjust W-4 forms when life changes alter your tax profile. Track refund status using official efiling confirmations and agency portals; retain efile acknowledgment numbers and copies of filed returns. If you use third-party software or a tax preparer, store confirmation emails and payment receipts for their services. Accurate withholding records and efiling proofs reduce follow-up correspondence and processing delays.

Meeting deadlines, residency, and compliance

Keep a calendar of filing deadlines, estimated payment dates, and extension timelines for federal, state, or local returns. Residency rules can affect which jurisdictions require filings—document periods of physical presence, domicile changes, or cross-border income to determine obligations. Consistent documentation supports compliance and makes extensions or amended returns easier when circumstances change or estimates need refinement.

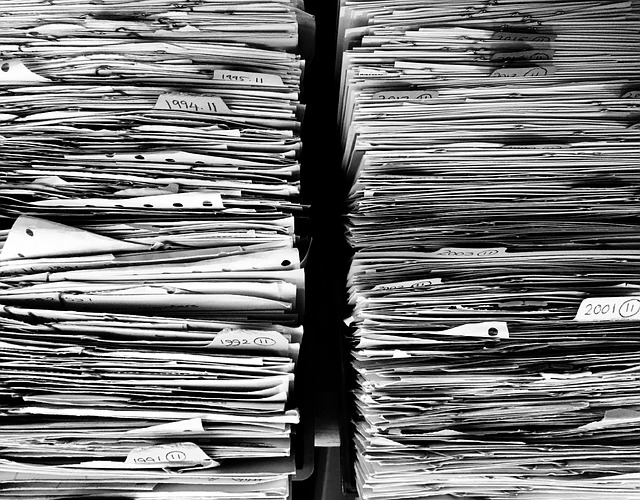

Preparing for audits and documentation retention

Maintain documentation for the recommended retention window: typically three years for most returns, longer for substantial omissions or property records. Keep payroll records, receipts, contracts, and correspondence that substantiate reported income and deductions. Create an organized folder structure—both digital and physical—and a simple index so you or an advisor can quickly gather documents if auditors request them. Clear, dated records reduce the time and stress involved in audits.

Accurate filings start with regular habit: capture source documents immediately, categorize consistently, reconcile accounts periodically, and retain evidence for deductions, credits, withholding, and refunds. A combination of digital tools, consistent naming conventions, and routine reviews supports efiling and compliance, and eases the burden of responding to audits or residency-related questions. By organizing income and expense records proactively, you create a reliable trail that backs your tax positions and simplifies each filing cycle.