Matching Bank Statements and Receipts for Clear Income Reporting

Accurate income reporting relies on pairing bank statements with receipts to create a verifiable record of transactions. Proper documentation and organized bookkeeping reduce errors at filing time, help with efiling preparations, and support compliance with deadlines and audit inquiries. This article explains practical steps to reconcile records and keep forms, withholding, and deductions clear.

Accurate income reporting begins with a clear habit: matching bank statements to the corresponding receipts. Consistent recordkeeping creates a reliable audit trail that supports reported income and documented expenses. When bank entries align with receipts and bookkeeping entries, efiling becomes smoother, forms are completed with confidence, and the risk of errors related to withholding, deductions, or credits is reduced. Establishing a routine for reconciliation saves time when deadlines approach and strengthens compliance if an audit arises.

How does bookkeeping support accurate filing?

Good bookkeeping provides the backbone for timely filing. A systematic bookkeeping process captures income, expenses, and withholding information as transactions occur. Categorizing each entry—whether a sale, refund, payroll withholding, or vendor payment—helps ensure that figures carried to tax forms reflect underlying receipts and bank records. Regular bookkeeping reviews also reveal missing receipts or misclassified expenses before forms are prepared, reducing the need for late corrections and improving overall compliance.

What documentation should you keep for income and expenses?

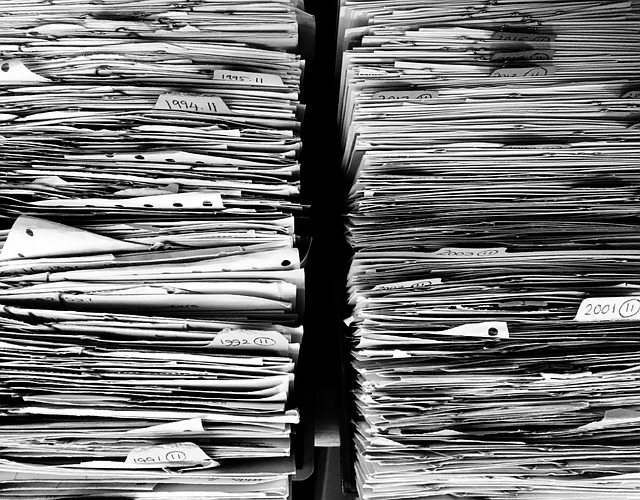

Maintain receipts, invoices, bank statements, payroll summaries, and any electronic records that substantiate amounts reported on tax forms. Documentation should show date, amount, parties involved, and the business or personal purpose of the transaction when relevant. For income, retain invoices, deposit slips, and contracts; for expenses, keep receipts, mileage logs, and supplier invoices. This collection of documentation supports deductions and credits and provides evidence in case of an audit.

How can reconciliation between bank statements and receipts work?

Reconciliation is the process of confirming that your bookkeeping records match the bank statement for a given period. Start by comparing the beginning and ending balances, then tick off individual transactions: deposits should match income receipts, while withdrawals or card charges should align with expense receipts. Investigate discrepancies such as duplicate entries, timing differences, or bank fees. Record adjustments with notes so the source of any change is transparent for future review and for forms that require exact totals.

How do efiling and forms depend on organized records?

Efiling a return or submitting forms electronically depends on accurate totals pulled from bookkeeping records. When records are organized, populating fields for income, withholding, and deductible expenses is straightforward and less prone to transcription errors. Organized documentation also helps when reconciling figures on information returns such as W-2s or 1099s. Accurate source data reduces the chance of receiving notices from tax authorities after efiling and supports timely responses if questions arise.

How do deductions, credits, and withholding affect reporting?

Deductions and credits lower taxable income or tax liability but must be supported by receipts and proper classification in your bookkeeping. Withholding figures from payroll or other payments should be recorded alongside income receipts so that totals reported match payer statements and forms. Misplaced or incomplete receipts can lead to overstated income or improperly claimed deductions, increasing audit risk or triggering adjustments. Maintain separate folders or digital tags for deductible expenses to simplify annual aggregation.

How to prepare for deadlines, compliance, and audits?

Establish monthly or quarterly reconciliation routines so records are complete well before deadlines. Document retention policies should specify how long to keep receipts and bank statements, typically aligning with statutory requirements in your jurisdiction. If an audit notification arrives, organized documentation enables swift responses: bank statements, receipts, bookkeeping reports, and relevant forms should be readily accessible. Clear notes on reconciliations and adjustments help auditors understand your records without extensive back-and-forth.

Conclusion Matching bank statements to receipts is a practical habit that strengthens income reporting through clearer bookkeeping, better documentation, and more reliable efiling. Regular reconciliation makes filing deadlines easier to meet, supports claims for deductions and credits, and lowers the stress of potential audits by creating a transparent, verifiable trail of transactions.